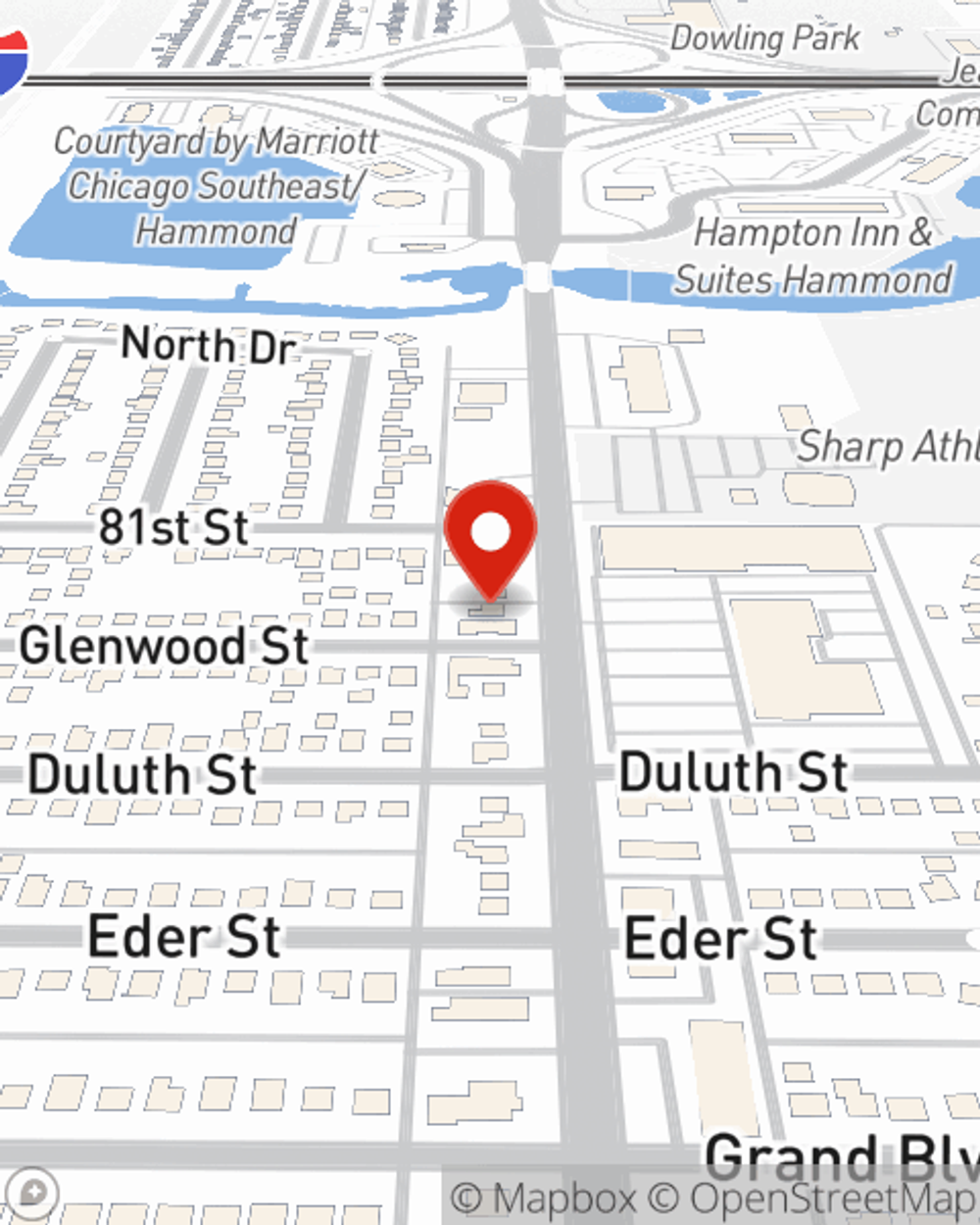

Homeowners Insurance in and around Highland

Looking for homeowners insurance in Highland?

The key to great homeowners insurance.

Would you like to create a personalized homeowners quote?

- HIghland, IN

- Munster, IN

- Griffith, IN

- Hammond, IN

- Schererville, IN

- Dyer, IN

- Crown Point, IN

- Valparaiso, IN

- Hobart, IN

- Merrillville, IN

- St. John, IN

- Cedar Lake, IN

Home Is Where Your Heart Is

Your home and property have monetary value. Your home is more than just a structure. It’s all the memories you’ve made there. Doing what you can to keep your home protected just makes sense! And one of the most reasonable things you can do is to get excellent homeowners insurance from State Farm.

Looking for homeowners insurance in Highland?

The key to great homeowners insurance.

Don't Sweat The Small Stuff, We've Got You Covered.

You’ll get that and more with State Farm homeowner’s insurance. State Farm has coverage options to keep your home and everything in it safe. You’ll get a policy that’s personalized to match your specific needs. Thankfully you won’t have to figure that out on your own. With deep commitment and fantastic customer service, Agent Todd Avery can walk you through every step to generate a plan that shields your home and everything you’ve invested in.

More homeowners choose State Farm® as their home insurance company over any other insurer. Highland homeowners, are you ready to check out what the State Farm brand can do for you? Get in touch with State Farm Agent Todd Avery today.

Have More Questions About Homeowners Insurance?

Call Todd at (219) 922-4343 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

Home security gadgets to consider

Home security gadgets to consider

Take a look at these home security devices for ideas on how technology can create a more secure home for you and your family.

Simple Insights®

Home security gadgets to consider

Home security gadgets to consider

Take a look at these home security devices for ideas on how technology can create a more secure home for you and your family.